The mining industry is ending the year strongly, with evident upward trends for key activities such as exploration, financing and M&A, with the industry's market capitalization and commodity prices increasing for much of 2017, after a period of stabilization in 2016.

[S&P Global Ratings Report]:

Industry Top Trends 2018: Metals and Mining

According to the Industry Top Trends 2018: Metals and Mining report by S&P Global Ratings, "The outlook for upstream producers has generally improved, with a modestly positive rating bias for 2018. We expect the focus on financial prudence - particularly among the largest globally diversified miners - to persist into 2018 amid what our base case assumes to be a (continuing) generally supportive price environment. For global downstream producers, we expect relatively flat conditions on average, albeit with regional variation."

Gain strategic insights into 2018 Credit Outlook for the Metals and Mining industry.

[Insight]: How Would China Potentially Shape the Mining Industry in 2018?

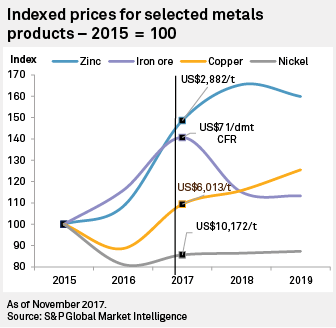

There has been a revival in the price of most metals this year. The drivers for this improvement are allied with China's macroeconomic story — robust credit expansion, environmentally minded processing and residential construction.

[Insight]: 2017 a year of gains by the mining exploration sector

The health of the mining industry's exploration sector improved markedly in the December 2017 quarter. S&P Global Market Intelligence's Pipeline Activity Index, or PAI, jumped to 87 from 77 in the September quarter, reaching the highest quarterly PAI since the March quarter of 2013, which saw 92, when the recent downturn was just beginning. In line with our predictions for the year, the S&P Global Market Intelligence Indexed Metals Price steadily improved, rising from 111 in the March 2017 quarter to 119 in the December 2017 quarter, its highest value since the September 2014 quarter.

Gain the latest insights on the mining exploration sector.

For more information on our Metals and Mining service, please visit: spglobal.com/marketintelligence.

Copyright © 2017 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved. No content may be reproduced or distributed without the prior written permission of S&P Global Market Intelligence or its affiliates. The content is provided on an “as is” basis.