By Maximilian Court | 23 November 2017

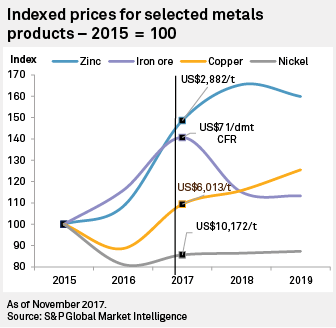

There has been a revival in the price of most metals this year — zinc is set to increase by almost 40% in 2017, copper and iron ore by approximately 20% and nickel should end the year up 6%, all on a year-over-year basis. The drivers for this improvement are allied with China's macroeconomic story — robust credit expansion, environmentally minded processing and residential construction. China's real GDP growth is expected to be 6.8% in 2017, and then — off this higher base — 6.5% in 2018, according to the International Monetary Fund.

At the same time, the key issues for 2018 pertain both to end-use demand but also risks to the supply chain. A major threat surrounds China's debt and the country's ability to sustain its real GDP growth rates — this is the process that determines the success of important large infrastructure spending such as the "One Belt One Road" suite of projects.