By Nick Wright | February 02, 2018

S&P Global Market Intelligence’s quarterly Industry Monitor reviews activities and trends in the mining industry's exploration and development sector.

Here's some highlights of the Q4 report:

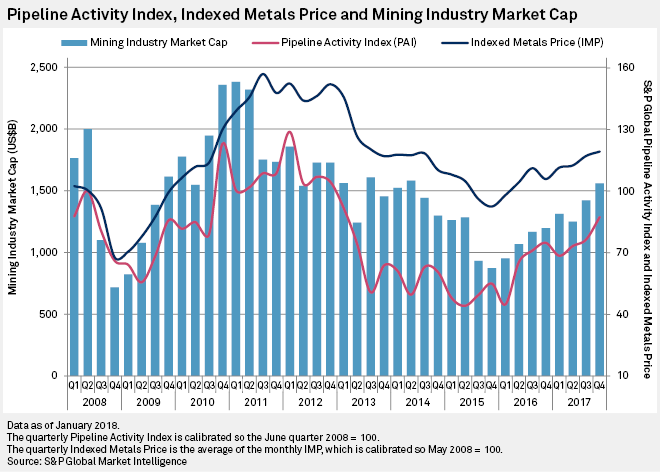

The health of the mining industry's exploration sector improved markedly in the December 2017 quarter. S&P Global Market Intelligence's Pipeline Activity Index, or PAI, jumped to 87 from 77 in the September quarter, reaching the highest quarterly PAI since the March quarter of 2013, which saw 92, when the recent downturn was just beginning. In line with our predictions for the year, the S&P Global Market Intelligence Indexed Metals Price steadily improved, rising from 111 in the March 2017 quarter to 119 in the December 2017 quarter, its highest value since the September 2014 quarter.

Globally, the number of projects reporting drill results rose 14% quarter over quarter, to 567 projects from 496. Minor base metals increased the most, tripling to 18 from six in the previous quarter, 14 of them for battery metal cobalt. Nickel and zinc-lead announcements followed with increases of 50% and 35%, respectively. Gold announcements rose 10% to 334, and copper remained flat at 54. Drill activity at specialty metals projects is worthy of note, since 32 of the 59 specialty metals announcements in the December 2017 quarter were for another battery metal, lithium.

The total number of drillholes rose 9% quarter over quarter to 11,688, with minor base metals doubling and nickel rising 49%. Zinc-lead and copper increased 30% and 28%, respectively, while gold and silver numbers remained stable.

Monitor the mining exploration sector with expert insights and deep asset data on mining companies.

REQUEST A DEMO

Copyright © 2017 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved. No content may be reproduced or distributed without the prior written permission of S&P Global Market Intelligence or its affiliates. The content is provided on an “as is” basis.