Brine operations margins almost double that of hard-rock producers

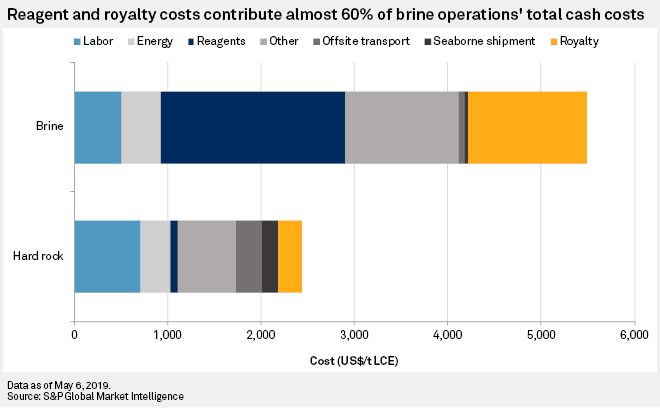

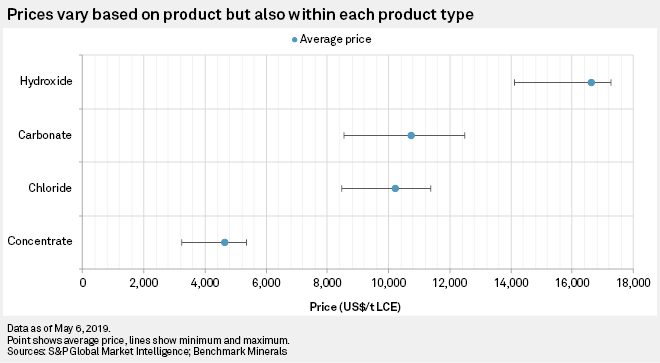

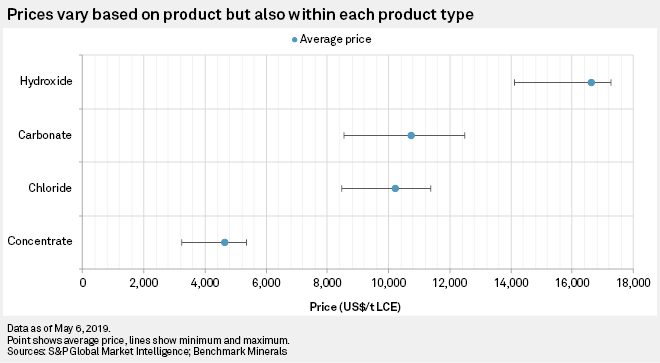

A better way to compare the economic performance of brine and hard-rock assets is to look at margins instead of costs as this also takes into account the price of each lithium product. Looking at the total cash margin on an LCE basis, which is gross revenue minus total cash cost, shows that brine operations on average are expected to achieve a margin of US$5,386/t LCE, which is almost double that of hard-rock producers. This is a result of the products obtained from brines having higher value than the concentrates produced at hard-rock mines, which outweighs the higher costs. On average, prices received for products of brine operations will be US$6,250/t LCE higher than those received for concentrates from hard-rock mines in 2019, which compares to average costs at brine operations being US$3,040/t LCE higher than at hard-rock mines.

Australian producers looking to capture more of the value chain

There is one notable exception to this trend: the margin for lithium hydroxide that will be produced at Greenbushes, a hard-rock mine that produces a spodumene concentrate. Two lithium hydroxide conversion facilities are being constructed in Western Australia to convert a portion of this spodumene concentrate. The first of these facilities, located 250 kilometers north of Greenbushes at Kwinana, is due to be completed in 2019, so from this year onward, Greenbushes will be producing both spodumene concentrate and lithium hydroxide. The additional cost of converting the spodumene concentrate to lithium hydroxide is expected to be US$2,456/t LCE in 2019; however, this is outweighed by the value addition to the product, which will increase from US$4,587/t LCE for spodumene concentrate to US$17,274/t LCE for lithium hydroxide. The significant addition to the price over the additional cost is what will lead to a higher margin for hydroxide over concentrate at Greenbushes. The significant value addition that can be achieved at these conversion facilities is driving other hard-rock producers in Australia, such as Mineral Resources Ltd. at Wodgina, to consider constructing such facilities near their existing operations. These decisions, however, also have to take into account the significant capital expenditure involved in constructing these conversion plants.

- By Adam Webb as of May 10, 2019. Original title: Lithium — Brines margins higher; Australians look to capture more of value chain

You may also like:

Copyright © 2019 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved. No content may be reproduced or distributed without the prior written permission of S&P Global Market Intelligence or its affiliates. The content is provided on an “as is” basis.