Lithium Sector: Production Costs Outlook

Lithium brine operations' margins are almost twice that of hard-rock assets. Some Australian producers are looking to capture more of the value chain and increase margins by constructing conversion facilities near their operations.

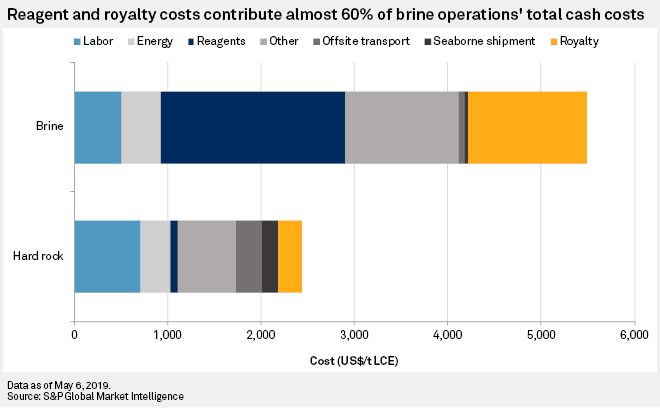

Lithium is produced mainly from brine and hard-rock deposits, both of which make distinct products of differing value. Average total cash costs in 2019 at hard-rock lithium mines are expected to be less than half of those at brine operations. However, the value of the concentrates produced at hard-rock mines is on average US$6,250/t LCE lower than that of the lithium chemical products produced at brine operations. The higher-value products from brines outweigh the higher cost and result in a forecast average 2019 margin of US$5,386/t LCE, almost twice that of their hard-rock counterparts. This value differential between products is encouraging Australian hard-rock producers to construct conversion facilities near their existing operations to capture more of the value chain and boost margins.