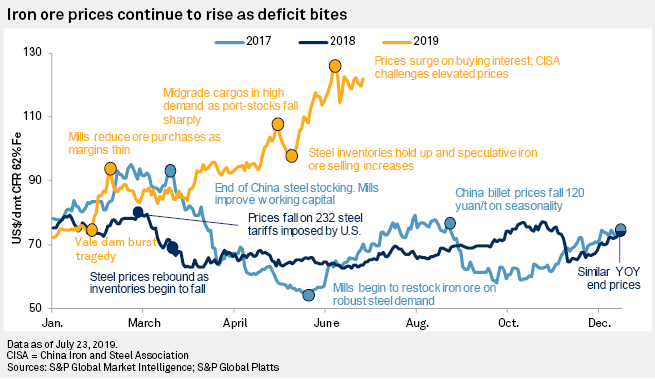

Iron ore prices soar on scarcity

By: Maximilian Court, Senior Research Analyst of S&P Global Market Intelligence | July 24, 2019

According to S&P Global Market Intelligence Iron Ore Commodity Briefing Service (July issue), prices for 62% Fe iron ores have remained at approximately US$90/t to US$100/t since the beginning of April and have been above US$100/t in their latest run since June 10. We have increased our price expectations on increased supply disruptions, though we hold our estimates for steel demand broadly constant given policy uncertainty and a long-held assumption of capacity curbs for the December half of 2019. We expect a greater seaborne iron ore deficit of 54 million tonnes, which is increased from 36 Mt due to larger-than-expected disruption at Rio Tinto's Pilbara mines in Australia and a slower resumption of idled Chinese concentrate capacity.