M&A Insights: Gold Mining Sector

Almost four times as much gold was acquired in producing companies and mines in 2018 than in nonproducers as buyers focused on adding production and reserves.

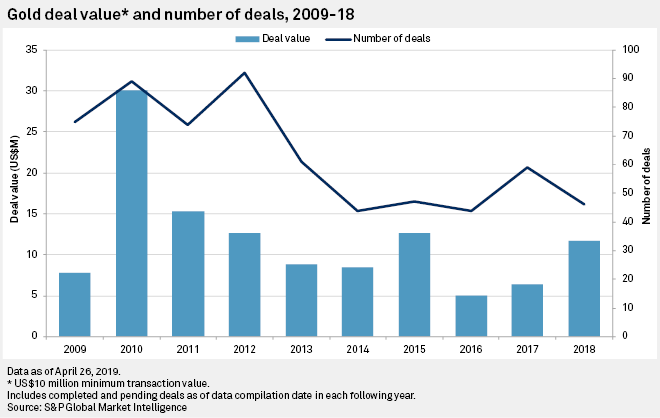

Boosted by the Barrick-Randgold merger announced in September, the deal value of pending and completed gold-focused transactions in 2018 increased 82% to US$11.72 billion from US$6.44 billion in 2017, and the average deal value rose 134% to US$255 million from US$109 million the year before. The gold deal value represented 47% of the US$24.89 billion total value of gold and base metals deals in 2018.

The Barrick-Randgold deal inspired rival Newmont Mining Corp. to announce a US$10.01 billion merger with Goldcorp Inc. in January 2019 to create the world's biggest gold producer. The number and value of deals are expected to increase in 2019, and the average deal value is likely to be influenced by any high-value divestitures by the two newly enlarged majors during the year.