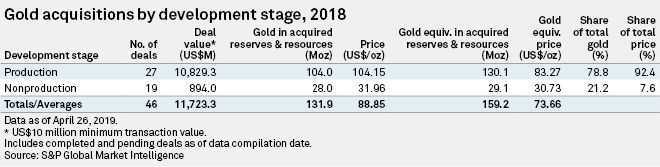

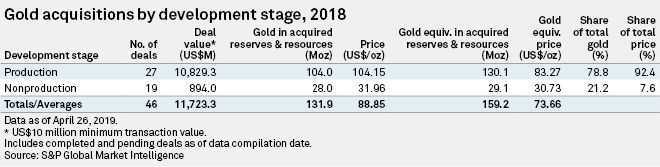

Buyers heavily favor producing mines over development-stage projects

Almost four times as much gold was acquired in producing companies and mines in 2018 than in nonproducers, with 104 Moz acquired in 27 producers and only 28 Moz acquired in 19 nonproducers. By contrast, in 2017 buyers favored nonproducing companies and projects, with 117 Moz in 35 nonproducers compared with 80 Moz in 23 producers.

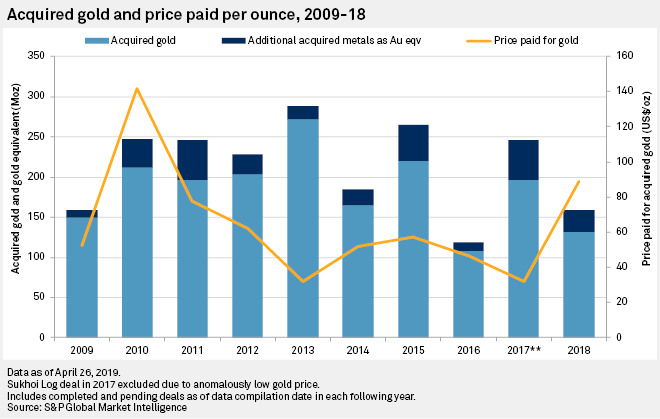

The traditionally higher value of producing assets, in combination with the higher proportion of acquired gold in producers, partially accounts for the higher price paid per ounce for all deals in 2018. However, the US$104/oz paid in producing deals in 2018 was still two-and-a-half times the US$42.19/oz paid for producers in 2017. This suggests that buyers may be switching from a longer-term strategy of picking up development-stage projects at low prices during the downturn to a strategy of replacing minable reserves, and even increasing production, over the near term in response to rising gold prices.

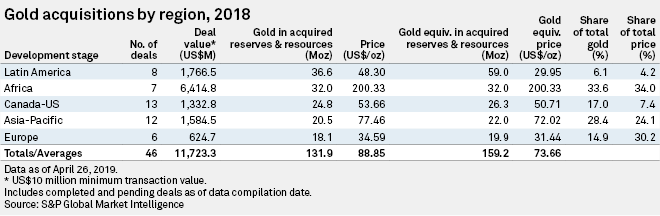

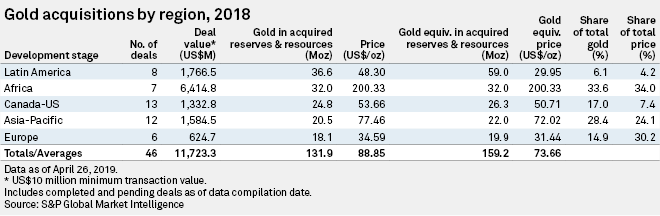

Latin America top region for acquired gold; Peru top country

Acquired assets in Latin America had the most gold in 2018 at 36.6 Moz in eight deals for an average gold price of US$48.30/oz, while the Canada-U.S. region had the most deals at 13, with a total of 24.8 Moz and a gold price of US$53.66/oz. Africa was second for acquired gold with 32 Moz in seven deals, five of them in West Africa and none in South Africa. The completed Barrick-Randgold deal accounted for 25.2 Moz, or 79%, of the region's total and also for a regional high gold price for a single deal of US$240/oz; no other African deal was above US$79/oz.

Asia-Pacific, including Australia, was fourth with 20.5 Moz in 12 deals at US$77.46/oz. Indonesia had three deals, including the Martabe gold mine, the region's largest deal with 7.2 Moz of gold. In December 2018, PT United Tractors Tbk. completed its acquisition of a 95% interest in Martabe for US$1.21 billion from an investor group that included EMR Capital Group and Farallon Capital Management LLC. Australia had seven of the region's deals, with only two containing more than 1 Moz of gold for a total of 5.7 Moz.

Europe was fifth with 18.1 Moz in six completed deals and the lowest cost at US$34.59/oz. In the two largest gold acquisitions, in November 2018 Polymetal International PLC completed its purchase of a 75.3% interest in the reserves development-stage Nezhdaninskoye project in Russia from a private investor for US$144 million, acquiring 9.1 Moz of gold. In the second-largest, Orion Mine Finance offered US$307.9 million for 78.2% of Dalradian Resources Inc., securing 4.8 Moz of gold at the feasibility-stage Curraghinalt project in Northern Ireland. The deal closed in September 2018.

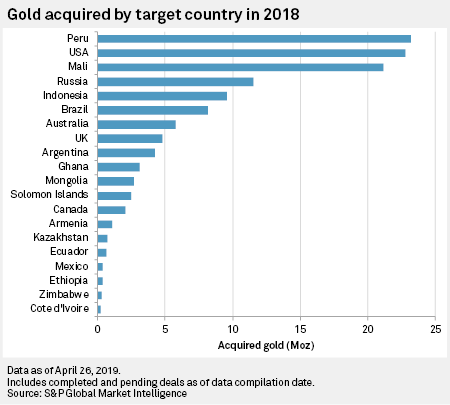

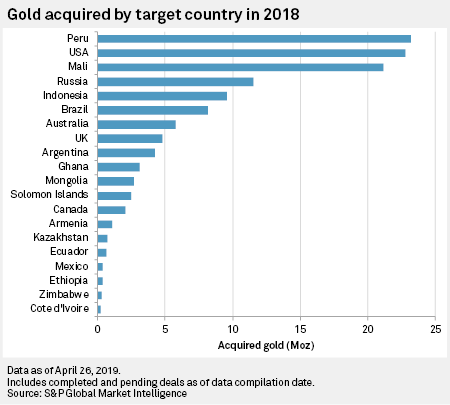

Peru was the top country globally for acquired gold, with 23.2 Moz. One large deal, Pan American Silver Corp.'s US$1.29 billion takeover of Tahoe Resources Inc., accounted for 62%, or 22.6 Moz, of all gold acquired in Latin America. Tahoe has two producing gold mines in Peru — La Arena and Shahuindo, with the latter scheduled to complete an expansion in the December 2019 quarter — and the Timmins mine in Canada. The deal closed in February 2019.

The U.S. was a close second with 22.8 Moz in 10 deals. There were six deals containing at least 2 Moz of gold in reserves and resources, the largest of which was Hecla Mining Co.'s takeover of Klondex Mines Ltd. in July for US$500.5 million. Klondex wholly owned three active gold mines, all in Nevada, containing 5.2 Moz of gold.

Mali followed a close third with 21.1 Moz, of which 18.3 Moz was in Randgold's Loulo mine. The West African country had one other deal with over 2 Moz of gold: Algom Resources Ltd., a unit of BCM Investments Ltd., acquired 80% of the Tabakoto mine, representing 2.8 Moz of gold, from Endeavour Mining Corp. for US$60.0 million in December 2018.

More deals and higher values expected in 2019

The outlook for 2019, based on acquisitions in the first quarter, is for the number and value of gold deals to rise year over year. The Barrick-Randgold deal inspired rival Newmont Mining to announce a US$10.01 billion merger with Goldcorp Inc. in January to create the world's biggest gold producer. Barrick then took a run at Newmont itself. The hostile takeover attempt was short lived, but it secured for Barrick a long-term goal of forming a joint venture with Newmont on the two companies' major Nevada assets, Barrick Nevada and Nevada Operations. The Newmont-Goldcorp deal was completed in April. Both newly enlarged major producers have announced their intention to divest a number of noncore assets, which promises a string of high-value mine and project deals over the next few years. In 2019, the average deal value is likely to hold steady or decline somewhat; however, this could change if a number of Barrick and Newmont Goldcorp post-merger divestitures come up for sale during the year.

By: Nick Wright, May 8, 2019. Original title of article: Gold M&A favors producing assets in 2018

Copyright © 2019 by S&P Global Market Intelligence, a division of S&P Global Inc. All rights reserved. No content may be reproduced or distributed without the prior written permission of S&P Global Market Intelligence or its affiliates. The content is provided on an “as is” basis.