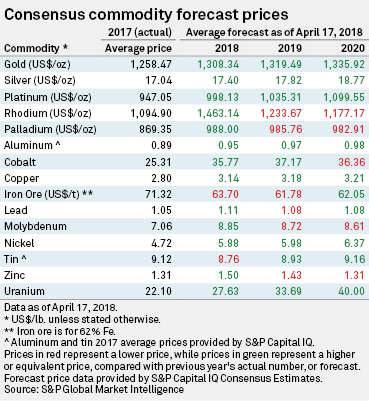

The commodities market continues to be optimistic, with most consensus forecasts as of April 17 for this year's prices surpassing the 2017 actual averages. This upward movement is consistent with the previous month's forecast.

The prices of precious metals remained steady after recovering at the end of March, due to investors looking for safety amid the current trade spat. Gold and silver rose 1.0% and 1.7%, respectively, in the last week, in tune with their rising consensus price forecasts from 2018 to 2020. Despite higher price forecasts for rhodium and palladium in 2018, they are expected to decline in 2019 and 2020.

A number of base metals also saw an increase in the past week. Copper grew 0.9% at US$6,787/t and nickel grew 3.4% at US$13,671/t. Aluminum jumped the most within the group, rising 12.9% at US$2,221/t, and is widely expected to continue performing well until 2020.

Most of the base metals are expected to perform well this year, but the same may not be said for the next two years. The consensus forecast is that the prices of several metals, including cobalt, lead, molybdenum and zinc, will decline.

Iron ore is still expected to average below its actual 2017 average price in 2018 and 2019, but the consensus price has risen to an average of US$62.05/t in 2020 from its February and March forecasts.