Essential Insights: Lithium Costs & Margins

Lithium brine operations' margins are almost twice that of hard-rock assets. Some Australian producers are looking to capture more of the value chain and increase margins by constructing conversion facilities near their operations.

Lithium is produced mainly from brine and hard-rock deposits, both of which make distinct products of differing value. Average total cash costs in 2019 at hard-rock lithium mines are expected to be less than half of those at brine operations. However, the value of the concentrates produced at hard-rock mines is on average US$6,250/t LCE lower than that of the lithium chemical products produced at brine operations. The higher-value products from brines outweigh the higher cost and result in a forecast average 2019 margin of US$5,386/t LCE, almost twice that of their hard-rock counterparts. This value differential between products is encouraging Australian hard-rock producers to construct conversion facilities near their existing operations to capture more of the value chain and boost margins.

Brine versus hard-rock

Lithium is currently produced from two main different deposit types: brines and hard-rock. At operations exploiting brine deposits, saline brines with high lithium content are pumped from beneath the surface. Lithium is concentrated via evaporation before the brine is sent on to processing facilities for the production of lithium carbonate or chloride. Lithium carbonate can then be further treated to create lithium hydroxide. At hard-rock operations, ore is extracted, usually from pegmatite deposits, using conventional mining techniques before it is concentrated via crushing, dense media separation and sometimes flotation to produce a concentrate. The primary lithium-bearing mineral in this ore is usually spodumene, and therefore most of these mines produce spodumene concentrate as the final product. The spodumene concentrate is then usually sold and shipped to lithium hydroxide or carbonate conversion plants, mostly located in Asia, where it is converted to these respective lithium chemical products.

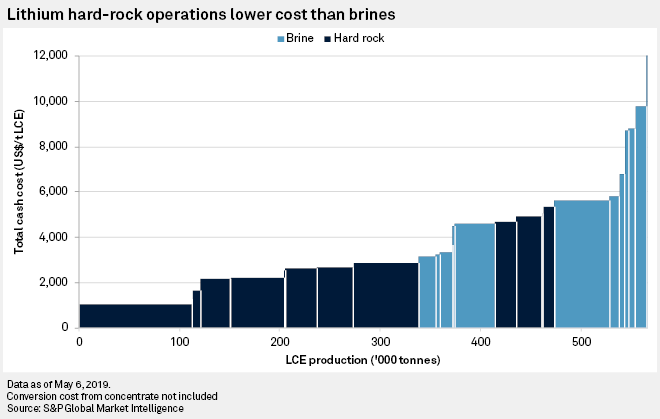

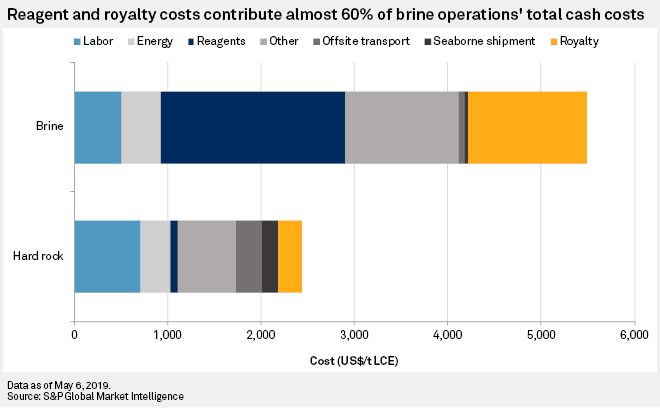

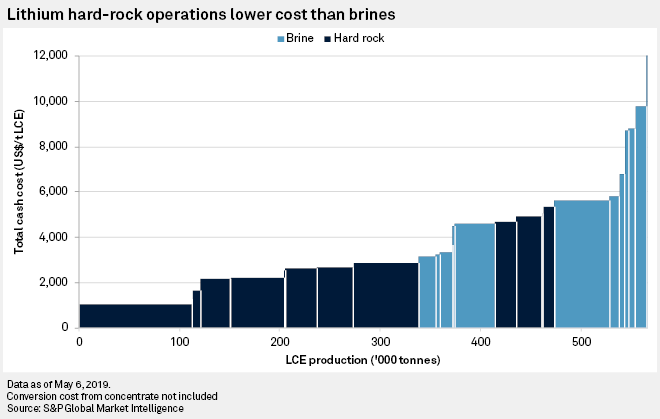

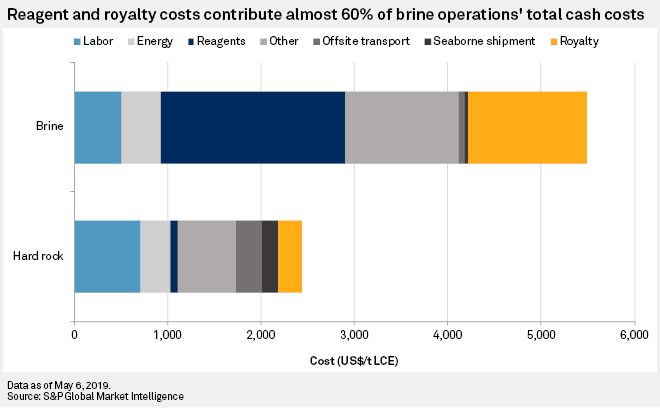

Hard-rock producers' costs less than half that of brines

The cost of producing concentrate at hard-rock lithium mines is generally lower than that of producing lithium chemical products from brines. In 2019, the average total cash cost across 11 operating hard-rock producers is expected to be US$2,540/t LCE, which compares with US$5,580/t LCE across nine brine operations. The most significant cost component at hard-rock mines is labor, which will make up almost 30% of total cash costs in 2019, compared to just 9% at brine producers. This is a result of the relatively high wages paid in Australia, where seven of the 11 hard-rock assets are located. Labor accounts for a lower proportion of brine operations' costs because of the comparative lack of personnel required to extract the resource out the ground, which is done via extraction wells, compared to conventional mining techniques. For brine assets, the biggest cost component is reagents for the downstream processing, which we forecast will account for 36% of total cash costs in 2019. These reagents are primarily sodium carbonate and lime, which are used to remove contaminants and precipitate lithium carbonate out of solution. Royalty costs are also notably high at brine operations, estimated at 23% of total cash costs in 2019. The royalty rate paid by Sociedad Quimica y Minera de Chile SA's and Albemarle Corp.'s assets on the Salar de Atacama in Chile were increased substantially in 2018 by CORFO, a Chilean government organization. This has led to royalty rates more than doubling in two years, from US$740/t LCE in 2017 to US$1,835/t LCE in 2019. As these are the two biggest brine producers in the world, this increase has had a significant effect on the global average royalty cost.

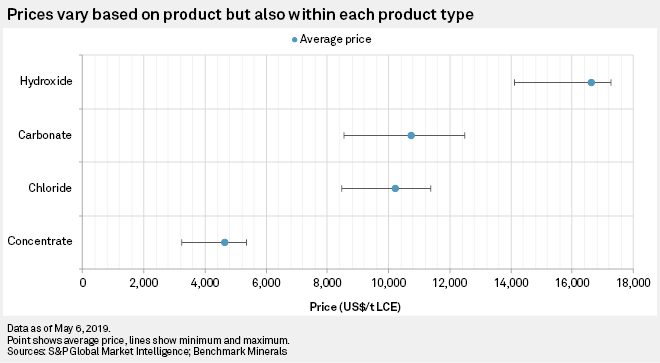

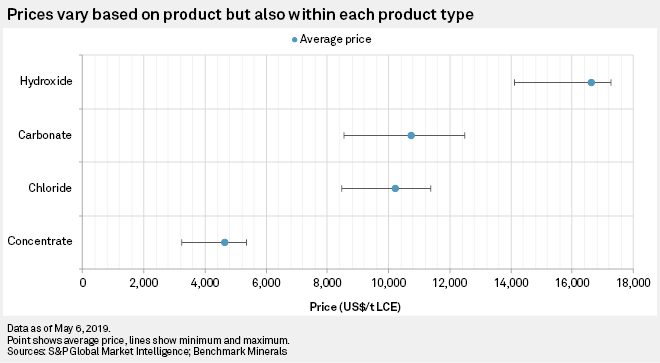

Pricing of lithium products variable

Although hard-rock producers have lower costs, the price they receive for their end product, usually spodumene concentrate, is significantly lower than that received for lithium carbonate, chloride and hydroxide, which are produced at brine operations. In 2019, lithium concentrates are expected to achieve an average price of US$4,619/t LCE, 57% lower than the price expected for lithium carbonate. The lower price for concentrates reflects the cost involved in the conversion to lithium hydroxide or carbonate, recovery rates at the conversion plants and the need for profits at these facilities. Lithium hydroxide currently receives a premium compared to lithium carbonate, which averaged US$2,458/t in 2018 and is expected to remain at similar levels this year, with the first-quarter 2019 average premium at US$2,500/t. This premium is per tonne of product and is amplified when looking at prices on a lithium carbonate equivalent basis as lithium hydroxide has a lower LCE content than lithium carbonate. The other important thing to note about lithium prices is that they vary not only across different product types but also within each individual product type. For example, forecast 2019 lithium carbonate prices for nine brine operations range from a minimum of US$8,552/t LCE to US$12,500/t LCE, and similar variability can be seen across concentrates, chloride and hydroxide. Most lithium products are traded using long-term contracts, and prices vary based on both the lithium content and impurities and the price-negotiating strategies of the operating company. These differences in prices between various products and within individual product types make it difficult to compare different operations on a like-for-like basis on the cost curve.

Brine operations margins almost double that of hard-rock producers

A better way to compare the economic performance of brine and hard-rock assets is to look at margins instead of costs as this also takes into account the price of each lithium product. Looking at the total cash margin on an LCE basis, which is gross revenue minus total cash cost, shows that brine operations on average are expected to achieve a margin of US$5,386/t LCE, which is almost double that of hard-rock producers. This is a result of the products obtained from brines having higher value than the concentrates produced at hard-rock mines, which outweighs the higher costs. On average, prices received for products of brine operations will be US$6,250/t LCE higher than those received for concentrates from hard-rock mines in 2019, which compares to average costs at brine operations being US$3,040/t LCE higher than at hard-rock mines.

Australian producers looking to capture more of the value chain

There is one notable exception to this trend: the margin for lithium hydroxide that will be produced at Greenbushes, a hard-rock mine that produces a spodumene concentrate. Two lithium hydroxide conversion facilities are being constructed in Western Australia to convert a portion of this spodumene concentrate. The first of these facilities, located 250 kilometers north of Greenbushes at Kwinana, is due to be completed in 2019, so from this year onward, Greenbushes will be producing both spodumene concentrate and lithium hydroxide. The additional cost of converting the spodumene concentrate to lithium hydroxide is expected to be US$2,456/t LCE in 2019; however, this is outweighed by the value addition to the product, which will increase from US$4,587/t LCE for spodumene concentrate to US$17,274/t LCE for lithium hydroxide. The significant addition to the price over the additional cost is what will lead to a higher margin for hydroxide over concentrate at Greenbushes. The significant value addition that can be achieved at these conversion facilities is driving other hard-rock producers in Australia, such as Mineral Resources Ltd. at Wodgina, to consider constructing such facilities near their existing operations. These decisions, however, also have to take into account the significant capital expenditure involved in constructing these conversion plants.

- By Adam Webb as of May 10, 2019. Original title: Lithium — Brines margins higher; Australians look to capture more of value chain

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Where does your company rank on the global lithium cost curve?

Gain essential insights into the cost efficiency of global lithium mines production.

The 2019 lithium cost curve is a new addition to S&P Global Market Intelligence Mine Economics data set, which covers mine production costs across 15 commodities.

- Identify operational efficient lithium mines with our intuitive charting tool that enables you to group, filter, label and highlight multiple cost curves by property, equity owner or geography.

- You can save time and rely on our reliable, detailed data on mine level production, costs and cash flows, to evaluate the margins of lithium mining projects or companies.

- Perform sensitivity analysis on our models to evaluate how unanticipated market changes may affect margins of lithium mining companies. Our flexible models enable you to analyse mine value, costs and production, for insight to react to the market.

Source: S&P Global Market Intelligence, April 9, 2019. Image for illustration purposes only.