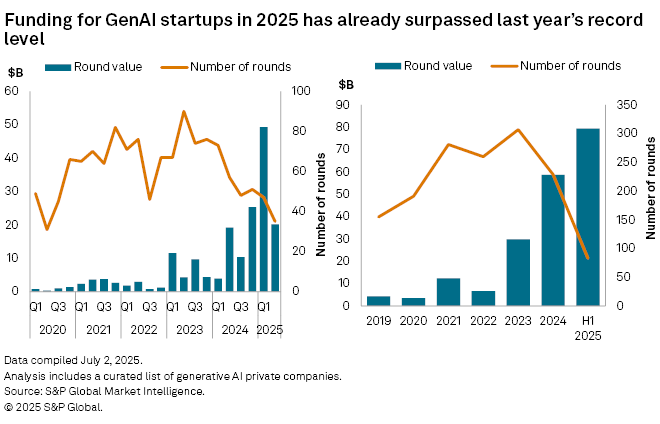

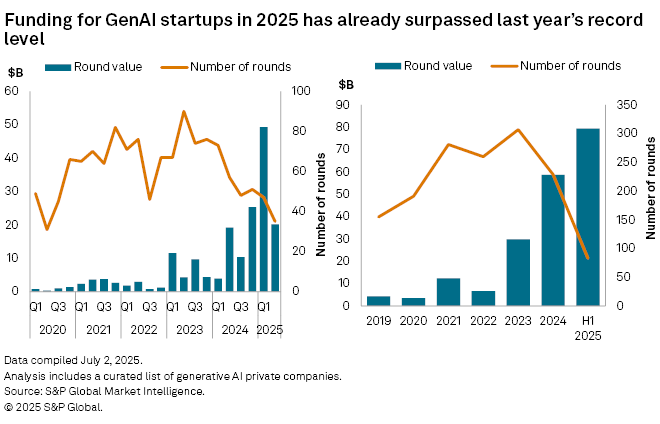

Just six months into 2025, funding for generative artificial intelligence companies has already surpassed 2024's record-setting full-year total, reflecting competition on the rise for resources and talent among leading frontier foundation model providers.

In the first half of 2025, investors allocated approximately $70 billion to GenAI companies, surpassing the $58.7 billion seen in the full prior year. This increase was primarily driven by two significant transactions: OpenAI Inc.'s $40 billion funding round and Scale AI Inc.'s sale of a minority stake to Meta Platforms Inc. for $14.8 billion.

The competition within the foundation model sector has intensified. Meta Platforms seeks to poach leading AI professionals from rivals such as OpenAI and Safe Superintelligence Inc. as Meta is experiencing delays in launching its newest model iteration. Meta has repeatedly delayed the release of its larger Llama 4 "Behemoth" model reportedly due to a lack of significant progress over previous models. The release, originally slated for April, is now set for some time in fall 2025.

Owning the infrastructure

Foundation model providers such as OpenAI are increasingly developing their own computing infrastructure to reduce dependence on hyperscalers like Microsoft's Azure and Amazon's AWS, which are simultaneously producing rival products. In the AI value chain, owning your own cloud infrastructure makes it easier to develop new iterations of foundation models and service inferencing for applications.

X.AI Corp., led by Elon Musk, was among the first to establish a large-scale datacenter filled with NVIDIA Corp. GPUs, followed by OpenAI's Stargate Project. More recently, Mistral AI SAS, Europe's only competing frontier model provider, unveiled plans to build its own GPU infrastructure, supported by the French government, as Europe plays catch-up in generative AI development.

In the second quarter, the GenAI infrastructure segment received the largest share of funding, primarily due to the acquisition of Scale AI, a company specializing in data labeling for foundation model developers. Following this acquisition, Scale AI founder Alexandr Wang will lead Meta's AI initiatives.

However, for the first half overall, the application layer attracted most of the funding.

All about the application layer

In the application layer, the first quarter marked a record of funding for AI companies that do not own frontier foundation models.

In the second quarter, large funding rounds were recorded by GenAI companies such as Abridge AI Inc., which provides conversational tools for medical professionals; Grammarly Inc., a grammar-checking tool that is now pivoting into enterprise productivity; and Runway AI Inc., a provider of video and image creation tools for creative professionals.

Second-quarter totals reached a record $2.4 billion, surpassing the previous record set in the fourth quarter of 2024.

During the early GenAI boom, many companies leveraged third-party foundation models to create niche products. These firms, called AI wrappers, were often seen as vulnerable amid fierce competition from large private model providers and major public hyperscalers.

Several of these wrappers have achieved significant success, either by focusing on niche markets that are less attractive to larger competitors or by employing innovative strategies to address broader markets. Their flexibility in not being committed to any specific model has served as an advantage, allowing them to switch between models based on the complexity of customers' prompts. Furthermore, they are developing proprietary models by leveraging open-source models such as those provided by Meta Platforms.

Perplexity AI Inc., a search company, has surpassed $100 million in annual recurring revenue. Anysphere Inc., known as Cursor AI, an early leader in AI-driven coding solutions, has achieved $300 million in annual recurring revenue. Highlighting the strategic importance of AI coding applications, OpenAI has reportedly agreed to acquire Exafunction Inc., known as Windsurf, a competitor of Cursor AI, for $3 billion to strengthen its position in this prominent and rapidly growing sector.

S&P Global Market Intelligence 451 Research forecasts that AI coding revenue will experience the highest growth rate through 2029, with a projected compound annual growth rate of 53.4%. This significant increase is attributed in part to the growing use of generative AI coding tools by individuals without programming backgrounds, a trend referred to as "vibe-coding."

Back to infrastructure

While the increase in funding to the application layer is substantial, the GenAI infrastructure sector also received significant venture capital investments during the first half of the year. A notable event was the initial public offering of CoreWeave Inc., a prominent neocloud selling access to NVIDIA GPUs.

AI clouds remain one of the most funded categories in the infrastructure space, even with the exit of Coreweave. The AI neocloud space, largely supported and Advanced Micro Devices Inc. to create competition for the hyperscalers, remains very crowded, with consolidation likely to take place at some point. Coreweave recently announced the acquisition of Core Scientific Inc. for $9 billion in an all-stock deal.

In the software infrastructure category, one prominent attractor of venture capital has been data companies. Meta's "acqui-hire" of Scale AI, a deal done specifically to bring on talent, is a case in point. Scale AIs sale to Meta has prompted a few foundation model customers to leave, including OpenAI and Anthropic PBC, likely leaving open the data labeling space to new entrants. Scale AI competitor Snorkel AI Inc. received a $100 million funding round at a valuation of $1.3 billion last quarter.

Beyond the battles in the frontier large language model space, organizations increasingly need software solutions to successfully launch GenAI projects, including LLM and data security, LLM development, evaluation and testing.

According to 451 Research's latest survey, AI project abandonment within organizations surged this year versus 2024. Some reasons are cultural and organizational, including a lack of desire from employees to adopt new tools, but others are more technical. This is where a lot of the companies in the AI infrastructure category help organizations speed up and make GenAI adoption smoother.

Competition among foundation model giants is expected to persist as leading companies strive for dominance in the industry. But cracks are beginning to show. Competition in the space is expensive, and although revenue is increasing rapidly, losses are also mounting, requiring more investor funding. Investor skepticism is beginning to surface. At the start of the third quarter in July, X.AI secured $10 billion through debt and equity, but the company had to pay a steep interest rate on the debt.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

![]()