|

Please bookmark this page or save the URL

|

Excellence requires more than a sharp mind. In today's competitive world of academia, excellence requires access to respected, comprehensive data.

We not only provide that data, but whether your need is curriculum-based, project-oriented, or research-focused, we have the tools to make you smarter with every click.

Fill out the form on the right and we'll put you in contact with a representative to get started shortly

Please join us for 3 in depth courses showcasing our Capital IQ platform and how you can apply our data and tools to your classroom needs. Featuring JP Tremblay, CFA and Associate Teaching Professor at the Reiman School of Finance, Daniels College of Business at the University of Denver and Academic Advisor to the Finance Club and Marsico Student-managed Investment Fund.

Course 1 - Introduction to Capital IQ:

This course provides an introduction to the basic layout & data content areas of CIQ: companies, people, and transactions. Through the screening tool, we review 3 case studies by screening on those areas.

Introduction to Capital IQ (41:16)

Course 2: Security Analysis:

This course digs deep into security analysis as a 5 part series with corresponding practice exercises on the equity research process, financial analysis, industry research, and valuation techniques.

The Equity Research Process (35:57)

Understanding the Industry (12:09)

Financial Analysis (10:36)

Equity Valuation (27:22)

Relative Valuations (16:03)

Course 3: S&P Capital IQ for Student Managed Funds

This course provides a two-part review of how to use S&P Capital IQ for quantitative analysis and portfolio management courses which can be directly applied to you student managed investment funds.

Portfolio Management (7:56)

Quantitative Analysis with the Alpha Factor Library (13:49)

Placeholder for next video series

Take a deep dive with three insightful courses: learn how you can apply our data and tools to your classroom needs.

About Our Academic

Prof. JP Tremblay, University of Denver

Professor JP Tremblay, is a CFA and Associate Teaching Professor at the Reiman School of Finance, Daniels College of Business at the University of Denver and Academic Advisor to the Finance Club and Marsico student-managed Investment Fund. His courses cover: investment management, securities analysis and valuation, portfolio management and risk analytics. Previously, Professor Tremblay managed a portfolio of financial data products and analytical software platforms for the global institutional investment management market. He was also co-portfolio manager of a

long/short equity hedge fund and private wealth management firm based in Denver, CO.

Course 1 - Introduction to Capital IQ (41:16)

This course provides an introduction to the basic layout & data content areas of CIQ: companies, people, and transactions. Through the screening tool, we review 3 case studies by screening on those areas.

Course 2: Security Analysis

This course digs deep into security analysis as a 5 part series with corresponding practice exercises on the equity research process, financial analysis, industry research, and valuation techniques.

Part 1 - The Equity Research Process (35:57):

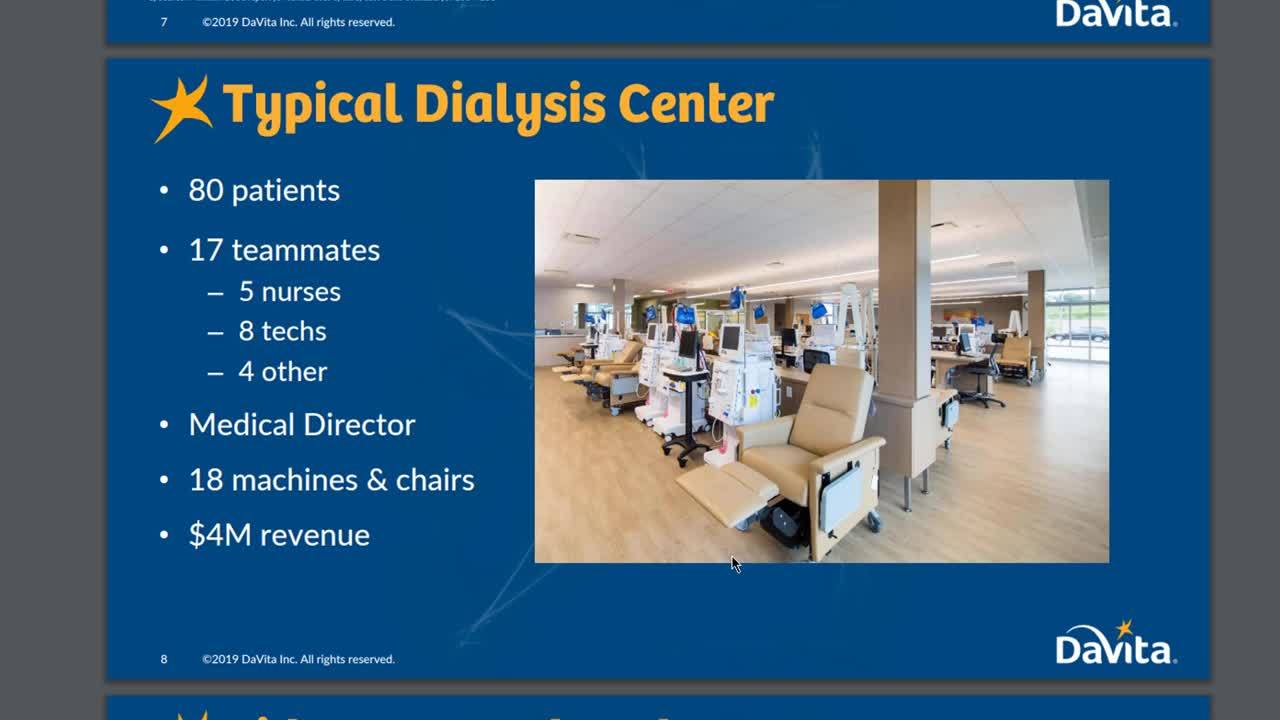

Learn how to understand the business by reviewing SEC Filings, Transcripts, Key Developments, & Segments Data. Review the management of a firm through key Professionals, Compensation Incentives & Public Ownership, and expand research of the industry-specific metrics of a firm.

Practice Exercise – Write a Business Description for Party City Holdco (PRTY)

Part 2 - Understanding the Industry (12:09):

Get to know the industry by reviewing CFRA reports through the NetAdvantage add-on, while also exploring Macroeconomic Data, Industry Aggregates, & Index Level Fundamentals.

Practice Exercise – Perform an Industry Analysis on the "Specialty Retail" industry for Best Buy (BBY)

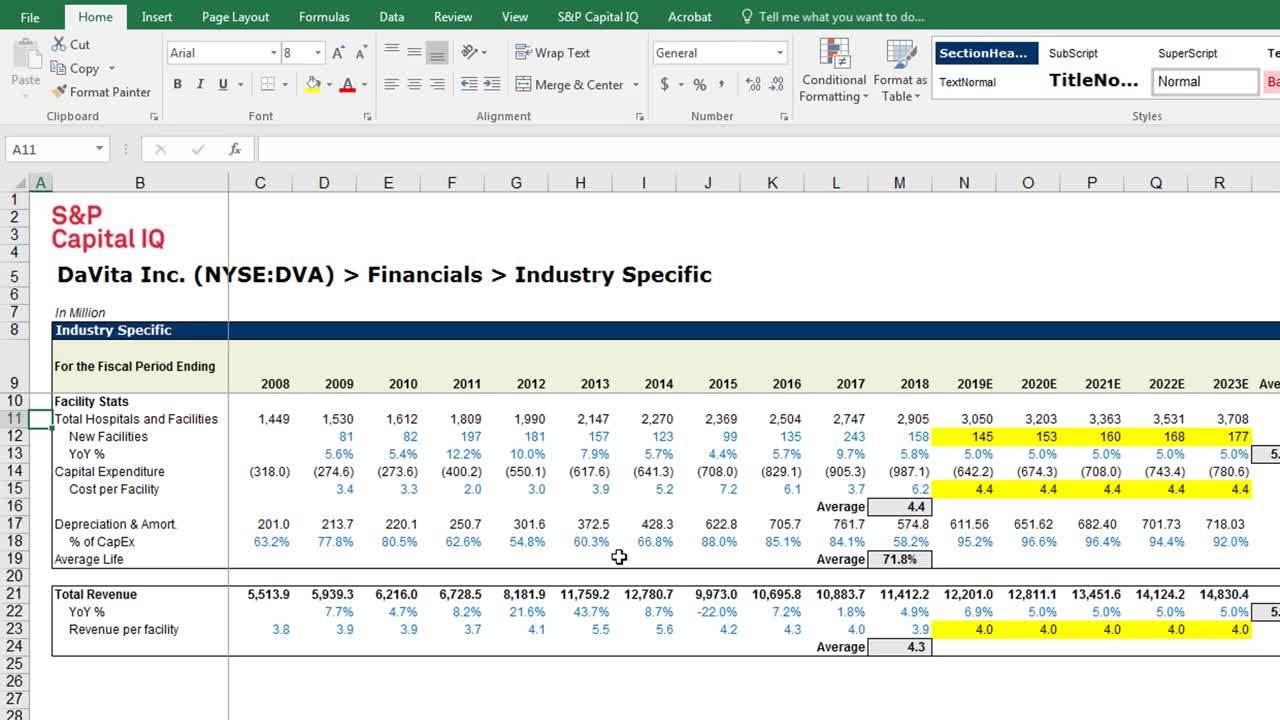

Part 3 - Financial Analysis (10:36):

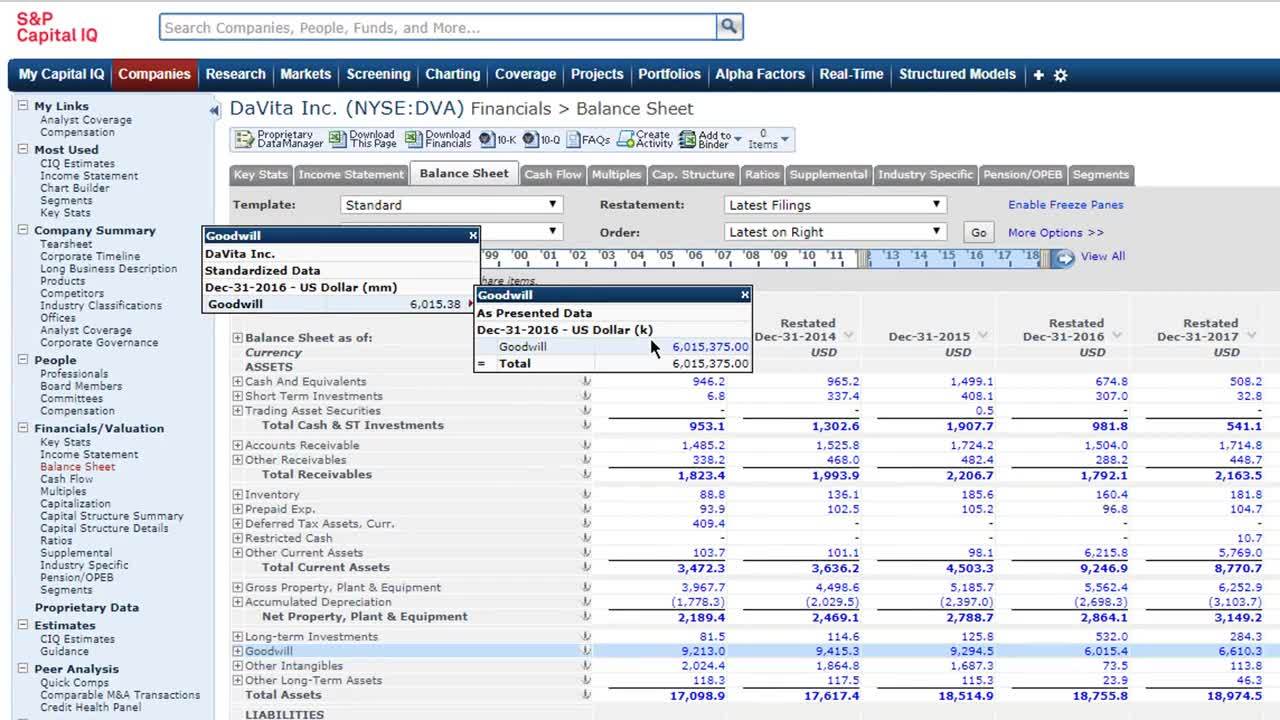

Dig deep into company financials by analyzing the Income Statement (standard vs. as-presented) & Balance Sheet (CIQ auditing). Learn why the DuPont Analysis is an important tool and see how the Excel Plug-in templates can be leveraged.

Practice Exercise – Perform a DuPont Analysis on Southwest Airlines (LUV)

Part 4 - Equity Valuation (27:22):

Understand what the Equity Valuation method entails by looking at a firm's Consensus Estimates and review CFRA Stock Reports through the NetAdvantage Add-On. Learn how to apply Discounted Cash Flow through Free Cash Flow Forecast Modeling, Revenue Forecasting & Cost of Capital/WACC. Apply Cost of Debt analysis by evaluating Capital Structure, Corporate Yield Curves, and Credit Ratings.

Practice Exercise – Calculate the Weighted Average Cost of Capital (WACC) for Southwest Airlines (LUV)

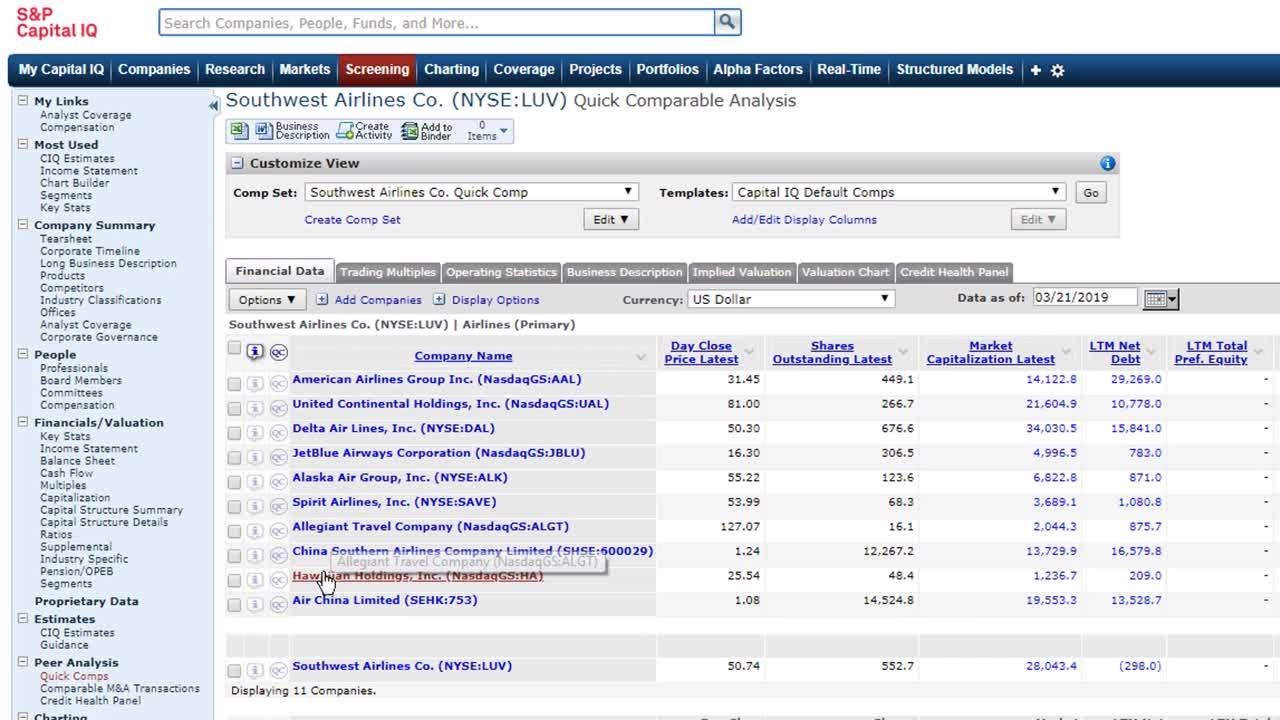

Part 5 - Relative Valuations (16:03):

Learn the 5 steps to Relative Valuation as you explore Comparable Analysis.

Practice Exercise – Apply Relative Valuation to value Chipotle Mexican Grill (CMG) using TV/EBITDA Ratio

Course 3: S&P Capital IQ for Student Managed Funds

This course provides a two-part review of how to use S&P Capital IQ for quantitative analysis and portfolio management courses which can be directly applied to your student managed investment funds.

Part 1 - Portfolio Management (7:56): Learn the Portfolio Analysis Tear Sheet Components by reviewing the importance of your Portfolio Characteristics, Sector Allocation, Return & Risk Analysis, and Performance Attribution. Find out how CIQ can help monitor your portfolio.

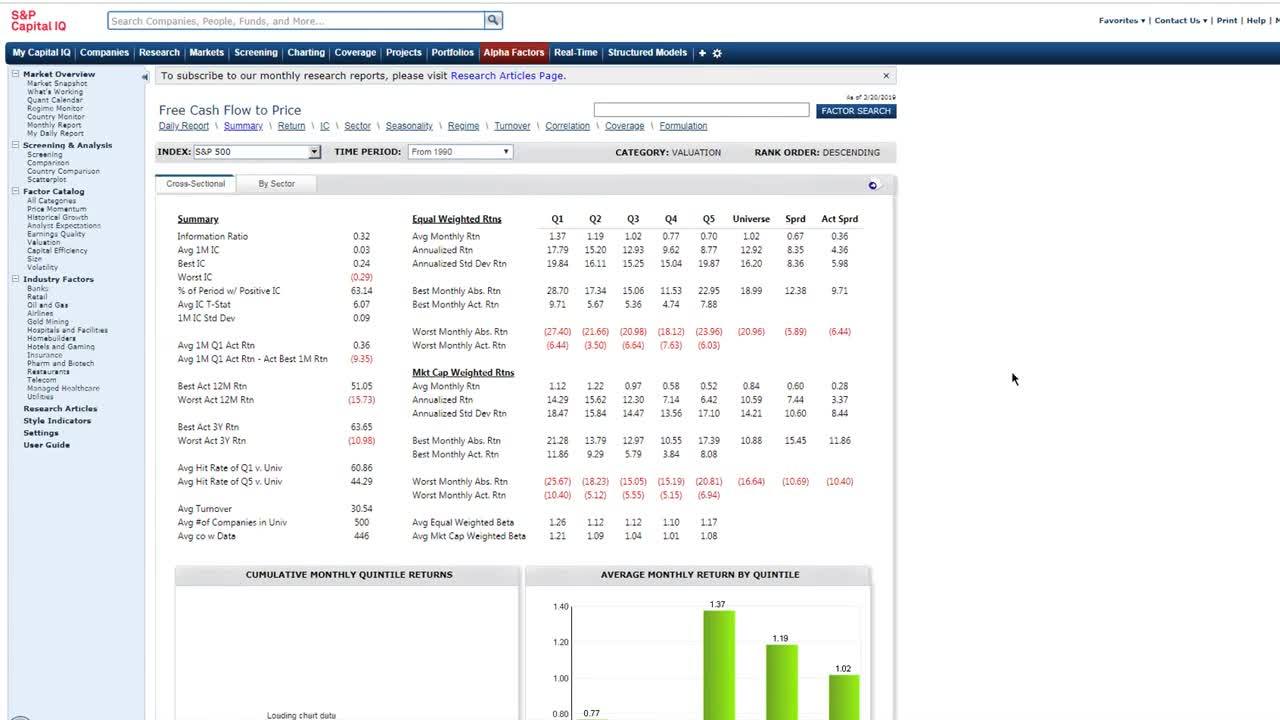

Part 2 - Quantitative Analysis with the Alpha Factor Library (13:49): Discover the power behind the Alpha Factor Library add-on tool and find out what factors in your portfolio are working. Explore the Valuation Library, understand Factor Performance (return, IC and regime) and learn about the importance of Factor Comparison.